Chinese Trading Company Overview

Chinese Trading Import Export Company Formation

Import Export License Application

Advantages of Using Hong Kong Company as Holding Company

China’s Trading Powers

The trading might of China is second only to the United States. Since national economy fluctuated in the past years, China’s import/export power plays a crucial role in the stabilization of the global economic landscape. This also ensures the sustained development of China’s domestic economy. On one side, as one of the troika of the economic growth and sustainability of China, the country’s import and export trade is also related to this incredible transformation and the upgrading of its domestic financial and economic structure. Another crucial factor to keep in mind is the deepening of global economic integration. What this means is China’s import and export trade is going to bring about unprecedented opportunities which will allow the deepening of international industrial divisions of labor cooperation along with promoting the stability of the international financial order. So, it makes sense for international enterprises to start a China Import Export Trading Company at this time.

Setting up a China Import Export Trading Company

It’s easy to see the benefits of a China Import Export Trading Company. The most common and acceptable business model for setting a trading business is trading WFOE (Wholly Foreign Owned Enterprise). This is a limited liability company with 100% shares owned by its foreign investors. It is crucial for a trading WFOE to be equipped with both an import and export license in order for it to be able to import or export commodities to and from China. The main reason for establishing a China Import Export Trading Company not is to return VAT, which is the most common way for foreign investors to invest in a business in mainland China.

Scope for Setting Up a Trading WFOE Covers:

• Wholesale commodities

• Retail products

• Import to China

• Export to the outside of China

• Commission agency

• Sell on China online using, Tmall, JD, Taobao or Alibaba

Business China has in-depth experience in helping foreign companies with a China Import Export Trading Company formation. The services we provide are tailor-made according to your specifications to do business in China so don’t hesitate to contact us to find out your options, and say “HELLO” to a new business destination.

Those business owners who are looking forward to starting their China Import Export Trading Company will need someone who knows the process of a China Trading WFOE Company Formation.

- Registered Name of a Trading WFOE

- During the process of a China Trading WFOE Company Formation, the business name will have to be made of four parts, i.e., the administrative division, company name, industry characteristics and organizational form. For example, the ‘Guangzhou Tian Di International Trade Co., Ltd.,’ “Guangzhou” will be the administrative division, “Tian Di” is the company name, “International Trade” is the name of the industry, and “Co., Ltd is the is the organization form.

- The administrative division is going to be the name of the foreign trading company that can be after the company name. For instance, “International Trading Company of Tian Di (Guangzhou); it can also be in the form of organization, for instance, “Tian Di International Trade (Guangzhou) Co., Ltd.

- The foreign trade company’s name should use Chinese characters under the national standard. The company’s name will be composed of two or more characters, and shall not appear in Pinyin letters, Arabic numerical. The China Trading WFOE Company Formation’s English surname shall have no particular requirement and can be placed on the company’s official stamp.

- Furthermore, approved by the government bureau with registered capital of around RMB 50 million, the China Trading WFOE Company Formation’s name can be used without an administrative division.

- The Minimum Amount of Registered Capital

Under the laws of a China Import Export Trading Company formation, the minimum amount of the registered capital of current foreign trade companies is without special provisions. That being said, the following are some of guidelines you need to follow while going for a China Import Export Trading Company formation:- According to practical experimentation, the minimum registered capital is closely linked with the real condition of the company which is to be on record. This includes, the current conditions of the primary products, services, enterprise business scale and proposed registration, including the different areas of the enterprise and the investor strength of your company.

- Normally, all small to medium sized foreign trade companies will have to choose to register for an amount of up to 5 million yuan, 3 million yuan, 1 million yuan, or 500,000 yuan, and of course, there is also going to be the option of registering for 30,000 yuan, 100,000 yuan and 300,000 yuan can also be registered. If the strength of the investor is said to be equal then the hither the registered capital, the feeling will be more assured. This is due to the fact that an amount that’s too small can negatively impact the business and the company.

- If the foreign trading company is in need to apply for the general taxpayer then it is recommended that the registered capital will need to be a bit higher.

Needless to say, there are plenty of problems that arise when it comes to a China Import Export Trading Company formation and dealing with registered capital, and the many other factors that go into a China Import Export Trading Company formation, which is why you are going to need the guidance of the experts when it comes to a China Trading WFOE Company Formation.

- Time Limit and Method of Capital Contribution of a Trading WFOE

- The shareholders of the China Trading WFOE Company Formation are not required to pay the entire capital contribution in a single lump sum, and you will have up to 30 years to do the capital injection.

- The trading WFOEs get to choose the method of the capital contribution. That being said, the amount for the initial period shall be no less than 15% of the amount of capital that was subscribed, and shall not be less than the statutory minimum amount of the registered money.

- The foreign investors are able to invest freely in convertible foreign currencies that are to be remitted from abroad to China.

- Previously, after the investors paid each period of the capital contribution, trading the WFOEs were to issue the capital verification report and submit it to the examination and approval authorities for filing after the capital contribution was received. However, this provision has been canceled in order to facilitate foreign investment in China. To find out more about this you can contact our consultants for China Trading WFOE Company Formation.

How to Apply for Import / Export License? Request for a Free Consultation.

Documents List:

- Passport or ID copy of Legal Representative

- Passport or ID copy of E-port Card Operator

- Permit of Opening the Bank Account

- Approval Certificate

- Business License

- Company Stamp

- Application Form

Import / Export License:

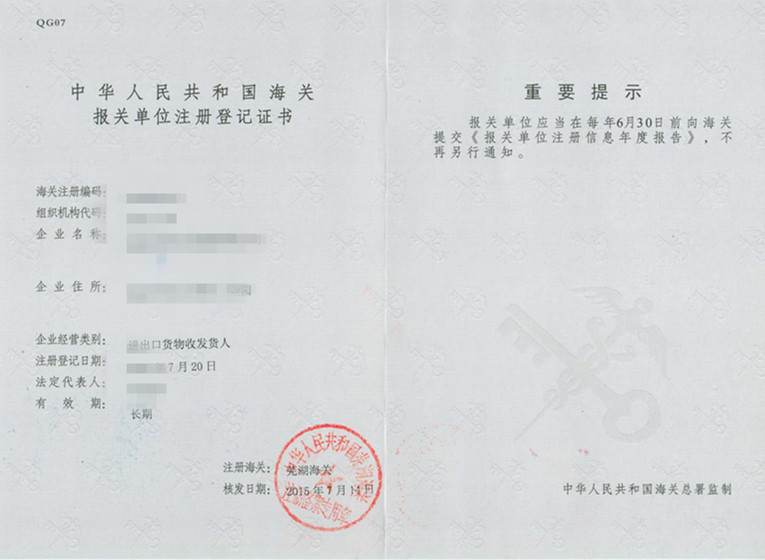

- Certificate of Registration of Customs Declaration Unit

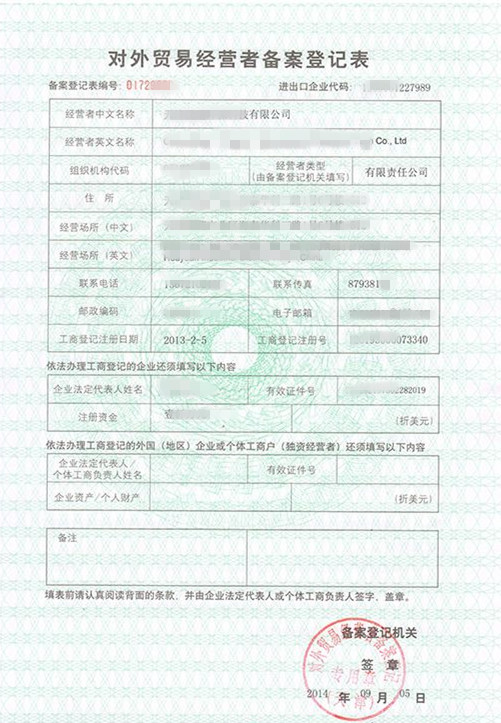

- Record of Foreign Trade Operators

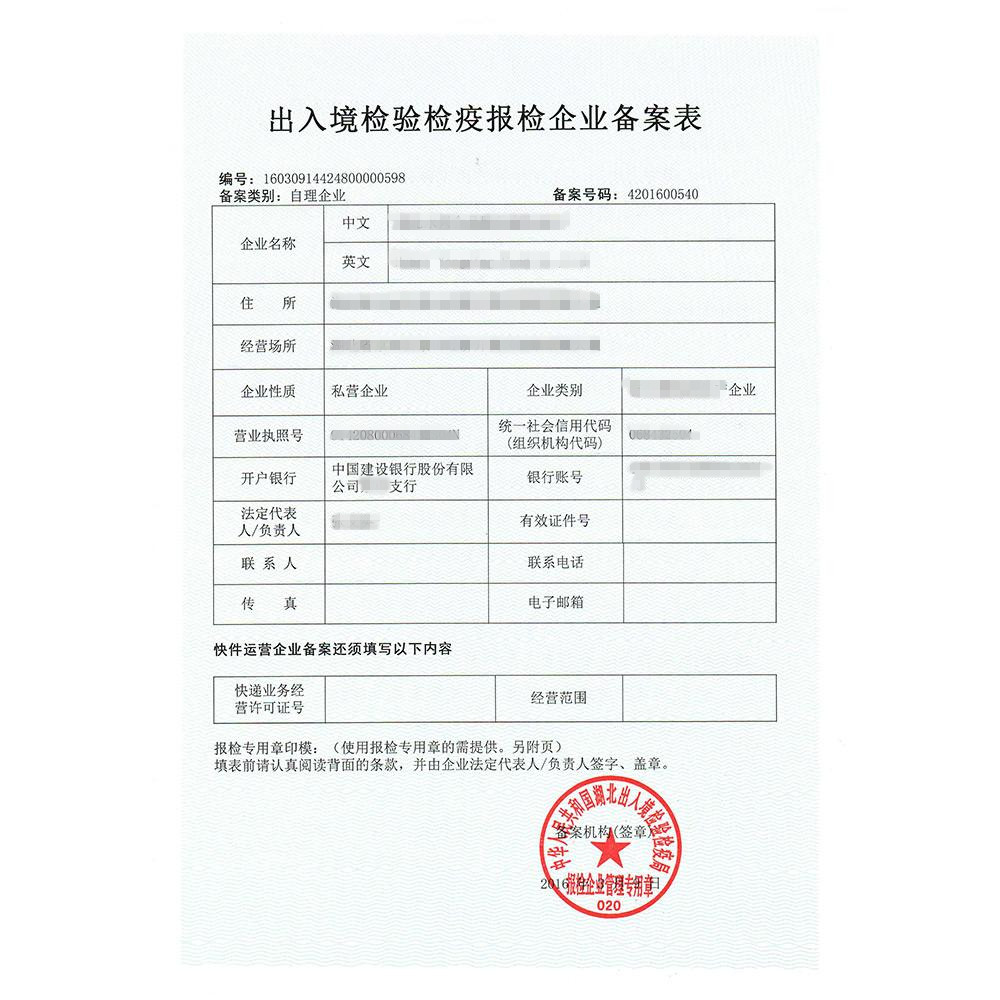

- Entry and Exit Inspection and Quarantine Inspection Enterprise-Record Form

- Electronic Port Card Reader / IC Card

- Foreign Currency Account

Registering a company in Hong Kong as an added component of setting up a legal entity in Mainland China has many taxation advantages. Tax rates are comparably lower by OECD standards, and it is mostly a tax-free safe harbor for international businesses.

What're the Advantages of Using Hong Kong Company as Holding Company of Trading WFOEs?

High Social Acceptance

Hong Kong’s world financial center status and its sound legal system to protect investors, Hong Kong company have regarded as the most convenient way and most natural channel to start the international business. It will improve your customers’ trust in you and own your high social acceptance if you have a limited liability company based in Hong Kong.

Easy Formation

Hong Kong company needs no capital contribution and can establish within seven working days or even one day. Hong Kong company’s name has no limitation and could contain the country name, such as a Hong Kong company could name as “US Channel Limited,” which will give an impression that this could be a US company when a client first hears about it.

Business Flexibility

The beneficial owner of the HK company could easily change within 1 -2 working days to best minimize the business risks, which could be one of the reasons why Hong Kong company has used as a shell company as “protection umbrella.”

Limited Liability and Unlimited Protection

HK company is a limited liability company with responsibilities limited to its capital subscribed. Meanwhile, if the foreign investor uses an alien individual or a homeland mother company to hold the trading WFOE in China, it may have the possibility to drag them into a long-term lawsuit if mishandled the business operation in China. While using Hong Kong company holding the trading WFOE can further prevent the trial.

Tax Saved if Business Incorporated Correctly

Hong Kong company has renowned the world for its advantageous tax system. Only profit made from HK requires paying 8.25% profit tax. As long as the business incorporated correctly, a charge could save from Hong Kong side. Consult Business China.

As part of our services, we provide:

- Certificate of Incorporation

- Business Registration Certificate

- Original Formation File

- Formation File Certified by CPA

- Two Stamps and One Seal Press

- Share Certificate Booklet

- Appointment with Corporate Secretary for One Year

- Corporate Minutes Booklet

- Registered Business Address for One Year

Additional Services:

- HK Company Express Registration

- HK Bank Account Appointment

- Europe Offshore Bank Account Appointment

- Business Notary for China WFOE

Optional Service: We also offer a Guaranteed Bank Account Service so your bank account can be opened in Hong Kong successful. Read More